There are common mistakes and ‘traps’ that give nearly all traders trouble at some point in their trading careers. So, let’s cover the most common mistakes that traders make which keep them from making money in the markets:

There are common mistakes and ‘traps’ that give nearly all traders trouble at some point in their trading careers. So, let’s cover the most common mistakes that traders make which keep them from making money in the markets:

Analysis-paralysis

There is a virtually unlimited amount of Forex news variables that can distract a trader, as well as tons and tons of trading systems and trading software. You’ll need to sift through all of these variables and forge a trading strategy that is simple yet effective, warning; this can be a very a difficult task for beginner traders.

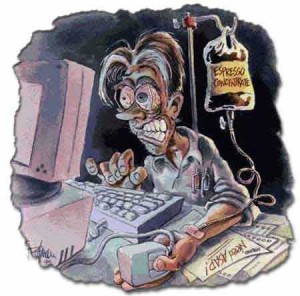

The reason why, is that most traders seem to think that ‘more is better’, when in reality ‘more’ is actually worse, as it relates to Forex trading. There really is no need to sit in front of your computer for hours on end analyzing Forex news reports or numerous indicators. My trading philosophy is that all variables that affect a market’s price movement are reflected via the price action on a price chart. So, spending your time and money on trading software, systems, or analyzing news variables is simply a waste. Furthermore, many traders get analysis-paralysis, this occurs when a trader tries to analyze so many market variables that they exhaust themselves to the point of making silly emotional trading mistakes.

Over-trading

Most traders do not make money in the markets over the long-run for one simple reason: they trade way too much. One curious fact of trading is that most traders do very well on demo accounts, but then when they start trading real money they do horribly. The reason for this is that in demo trading there is virtually no emotion involved since your real money is not on the line. So, this goes to show that emotion is the #1 destroyer of trading success. Traders who over-trade are operating purely on emotion.

Most traders do not make money in the markets over the long-run for one simple reason: they trade way too much. One curious fact of trading is that most traders do very well on demo accounts, but then when they start trading real money they do horribly. The reason for this is that in demo trading there is virtually no emotion involved since your real money is not on the line. So, this goes to show that emotion is the #1 destroyer of trading success. Traders who over-trade are operating purely on emotion.

Trading when your pre-defined trading edge is not actually present is over-trading. Trading if you have no trading plan or have not mastered a trading edge yet is over-trading. Essentially, you need to know EXACTLY what you’re looking for in the market and then ONLY trade when your edge is present. Trading too much causes you to rack up transaction costs (spreads or commissions), and it also causes you to lose money a lot faster since you are purely gambling in the market. You need to take a calm and calculated approached to the market, not a drunken-gamblers approach…which seems to be the favored approach of many traders.

Not Applying Risk Reward and Money Management Correctly

Risk management is critical to achieving success in the markets. Risk management involves controlling your risk per trade to a level that is tolerable for you. Most traders ignore the fact that they COULD lose on ANY TRADE. If you know and accept that you could lose on any trade…why would you EVER risk more than you were comfortable with losing??? Yet traders make this mistake time and time again…the mistake of risking too much money per trade. It only takes one over-leveraged trade that goes against you to set off a chain of emotional trading errors that wipes out your trading account a lot faster than you think. Check out this cool article on Forex money management for more.

No Trading Plan and No Routine or Discipline

Not having a Forex trading plan is perhaps the most prevalent trading mistake the Forex traders make. Many traders seem to think that they will create a trading plan “later on” or after they start making money or that they simply don’t need one or can just keep it “in their heads”. All of these rationalizations are simply keeping traders from achieving the success they so badly desire. If you don’t have a Forex trading plan that details all of your actions in the market as well as your overall trading approach and strategy, you will be far more likely to operate emotionally and from a gambling mindset. Beginner traders especially need a Forex trading plan to solidify their trading strategy and to create a guide that they use to trade the market from, and you can’t keep it in your head…you need to physically write out your trading plan and read it every day you trade.

Trading Real Money Too Soon or Gambling It

The urge to jump into the market and start trading real money is often too much for most traders to withstand. However, the truth is that until you have mastered an effective Forex trading strategy like price action trading, you really should not be trading real money. By “mastering” the strategy, I mean you should be consistently successful with it on a demo account for a period of 3 to 6 months or more, prior to going live. However, you don’t want to use demo account trading as a crutch…trading a real account is different due to the real emotions involved, so just be sure you switch to real-money trading after you have achieved success on demo…don’t be afraid of trading real money, because eventually you will need to make the switch to real money trading.

The urge to jump into the market and start trading real money is often too much for most traders to withstand. However, the truth is that until you have mastered an effective Forex trading strategy like price action trading, you really should not be trading real money. By “mastering” the strategy, I mean you should be consistently successful with it on a demo account for a period of 3 to 6 months or more, prior to going live. However, you don’t want to use demo account trading as a crutch…trading a real account is different due to the real emotions involved, so just be sure you switch to real-money trading after you have achieved success on demo…don’t be afraid of trading real money, because eventually you will need to make the switch to real money trading.

Also, be sure you are not just gambling your money away. Doing the things we discussed above; over-trading, over-leveraging, not having a trading plan, etc, these are all things that gambling traders do. Traders who don’t gamble in the markets are calm and calculating…they have a trading plan, a trading journal, and they know exactly what their trading edge is and when to trade it.