The problem with beginner traders is that they sooner than later tend to become over confident of their trade set-ups and once this over confidence sets in, they begin to expect guaranteed success. Over expectations of success leads to over leverage and then there is the danger of an account blow out.

It may also happen that the setup may indeed work out but it is crucial to note that it takes just one such event as described above to losing large amounts of your hard earned money. If there is anything worse than losing money then it is the emotional trading mistakes that are a sure sequel to such losses.

Only amateur traders will think in this manner because they simply cannot comprehend the meaning or importance of risk to reward scenarios or position sizing. This post aims at simplifying both position sizing and understanding the correct way to look at Forex trading like a pro.

More About Logic Less About Emotions

It is common place for every other Forex trader to search for a magic bullet to winning trades and most of them often spend countless amounts of time and precious amounts of money in this pursuit. But none of these traders have even the faintest clue about the significance of balancing their risk and rewards effectively or have an iota of knowledge about position sizing.

In actuality, Forex trading is more about possibilities and probabilities and less about hit and miss or emotions. There are better chances of success in Forex trading when you look at it from a mathematical point of view based upon probabilities rather than handling it like a game of chance based upon emotional impulses that lack any kind of logic.

If there is anything that can differentiate between an amateur Forex trader and a pro, then it is the mindset. Professional traders will always view the Forex market with a measured eye, whereas the amateurs will look at it as a game of chance.

Professional Forex traders know that the output is directly based upon the input. Hence they always measure their risks and rewards and balance them effectively and efficiently apply position sizing in such a manner as to reap maximum benefits, each time and every time they set out to place their trades.

The best advantage of using such a logical or mathematical approach towards Forex trading is that it leaves no scope for any sudden and unwarranted surprises or errors in judgment based on emotional upheavals. This in itself takes away a large slice of any possible losses, thereby furthering the chances of success.

Learn to Implement Advice Correctly

After spending even a small amount of time in Forex trading you tend to receive a lot of information, advises and recommendations, no necessarily in that order. But if there is one mantra that almost every trader has heard of, then it is about cutting the losses short and allowing the profits to run.

The problem is not because of a lack of advice. The actual issue is that no one elaborates further on this advice and most traders find out a simple way of implementing it by setting very small stop loss levels and unrealistically large profit targets. But little do they realize that Forex trading or Forex markets for that matter are anything but simple. The markets are best described as volatile and high volatility means high risk and higher the risk more complex is the method to tackle this risk.

Set Your Priorities Right

If you want to reap benefits in Forex trading you must focus more on your risks than your rewards. It sure sounds a bit paradoxical, but that is the fact of the matter. If your focus is only upon the profits then your entire attention is obviously on your rewards and your risks are lying unattended. That is a great danger and it is almost like turning your back on your enemy. You would not even know when your risks slowly creep up on you and chomp away your profits, leaving you to tackle heavy losses in the process.

To sum it up, professional Forex trading is all about effective risk management and if you have learnt how to do that well then you have mastered the art of trading currencies well. If you master your risk management efficiently, then profits are sure to follow automatically.

It is important to define a robust entry method, like price action setups, together with a correct recognition of risk to reward scenarios and having a logical approach.

You also must be capable of evaluating the information available and properly assessing it before setting your profit targets and reward goals. Simply aiming for high profits without applying any logic or understanding of the market scenario is not professional Forex trading but foolish greediness.

Be warned that you risk blowing up your trading account if you do not set logical and reasonable profit targets, which ideally can be 2, 3 or even 4 times your risk. But everything finally depends upon the market conditions at that particular point of time and your assessment of the risk factors.

Importance of Effective Position Sizing

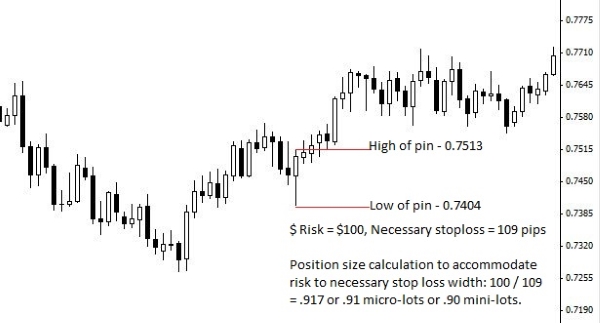

The importance of proper position sizing cannot be stressed enough and has a very crucial role to play in Forex trading. Though many Forex traders do realize the importance of this position sizing, they rarely ever learn to apply it correctly. The most dangerous mistake committed by Forex traders is to adjust their stop loss levels according to their preferred position sizing, whereas it should ideally be the other way round.

For example, if at all you have made a decision to put $100 per trade at risk and you perceive a fairly decent trade setup. In this scenario it is best advised to place your stop loss at 200 pips, because the ebb and flow of the markets make it highly volatile and your trade needs space to move around. But the right thing to do here would be to reduce the amount of money you were trading per pip, to arrive at this stop loss level. So if you were previously trading a dollar per pip then now you can reduce that to fifty cents per pip, because 50 cents x 200 pips will get you to $100.

Though it seems to be quite simple now, this is the most problematic point for majority of the Forex traders because it is exactly here that they bungle up. They tend to place their stop loss levels without any such calculations or logic and simply aim at trading a larger position size and this illogical greed only invites huge trouble, and most of the times the ending turns out to be fatal for the trading account.

Appropriate practice of position sizing not only guarantees increased amount of success at your trades, but it helps you to trade more accurately, since your stop loss levels are being placed at logical points above or below support or resistance levels, and there is no random or haphazard placing of stop loss levels. More you base your trades upon reason, logic, calculations and probabilities, better are your chances at reaping rewards and lesser are the chances of losses, unwelcome shocks and emotional upheavals.

The real magic bullet to successful Forex trading lies in proper blending of risk to reward balancing, effective position sizing and of course, application of intellect and logic.